Assets vs Liabilities – Understanding Wealth

If you want to build wealth or maintain a rich lifestyle you must understand the basics of assets vs liabilities. Have you ever seen someone gain a wealthy lifestyle, and soon after loose everything? That is a classic result of having too many liabilities and not enough assets. Having a solid understanding of these basics concepts with good strategic implementation will place you in a position to build wealth for years to come. Let’s go get it!

Press play to start Youtube video or start the podcast player below. Don’t forget to subscribe.

Listen on Anchor or choose your favorite podcast platform below!

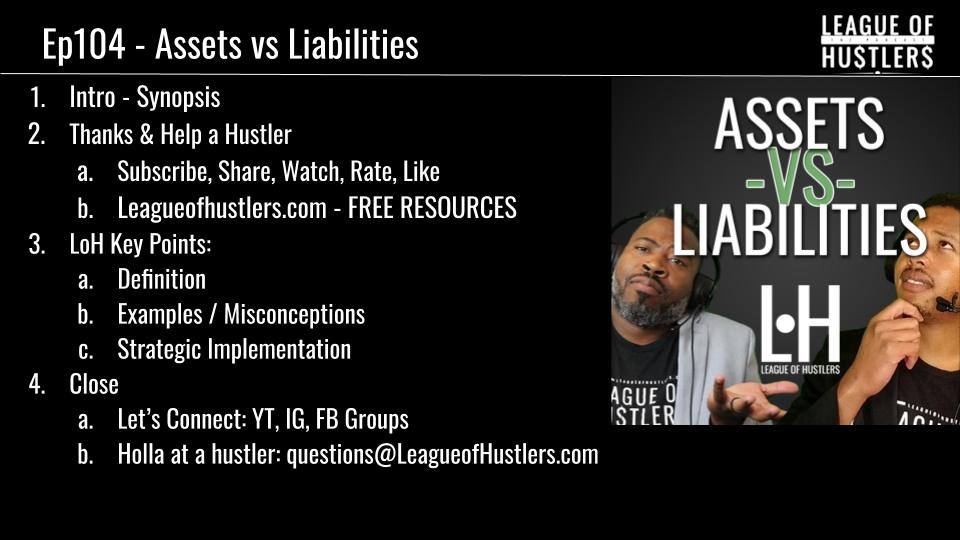

Overview: Assets vs Liabilities

LoH Key Points

The Definition of Assets vs Liabilities

Reviewing Examples and Misconceptions

Strategic Implementation

The Definition Of…

Step one is simply understanding the difference between assets and liabilities. Simply put an asset is something that will appreciate over time and/ or will add money to your pocket. A liability does the opposite. A liability is something that will depreciate in value and/or is causing you to spend money. Thus you have the constant battle of good vs evil, and assets vs liabilities. One is working to build your finance, and the other takes away from your finance. We all have liabilities, but it is our responsibility to balance them appropriately with our assets. We should be building strong, long lasting assets, and avoiding liabilities where we can.

Examples and Misconceptions

In the battle of assets vs liabilities there are a few misconceptions that we must consider. Most people think their home is an asset. However if you are not profiting from your home on a monthly or even annual basis the it is not an asset. Particularly because it requires you to spend money maintain it each month at a loss. It is a liability. However the same home could be rented out or upgraded and sold for a profit. That would make it an asset.

Vehicles are an item that are typically looked at as liabilities. However if you rented these vehicles out daily, for profit then they could land themselves in the asset column. In these examples we see that it is about the positioning of the item that determines whether it is an asset or a liability. Lets make sure we are positioning ourselves so that we have more assets than liabilities.

Strategic Implementation

We know now that an item can be both an asset and a liability based on its position. Its up to us to make sure we are being strategic about how we implement items so that we can benefit from them in the long run. What major purchases would you love to make that may not seem ideal or smart? Think about it again. How could you make that purchase, and turn it into an asset?

Thinking this way is how you can enjoy what you love, and make responsible financial decisions at the same time. For example let’s say you enjoyed sailing, but didn’t want to take on the liability of maintaining a sail boat along with all of the fees that go along with it. You could form a business around sail boating that allows you to enjoy sailing as well as make enough profits for your hobby to pay for itself and more. Strategic implementation is about looking at things differently, and positioning yourself to be profitable.

Challenge

Take a look at your current situation. Make a list of all of your assets, and beside it make a list of all of your liabilities. Remember, anything that brings money into your pocket consistently can be considered an asset. Things that take money out of your pocket are liabilities. Once you build your list, begin working on removing liabilities or transforming them into assets. Your objective is to make sure that you have more money coming in from the asset column, than you have going out in the liability column. Start building your list of assets. Review and update your list often. Maintaining healthy assets is a major key for wealth building.

Get on the LoH Mailing List

Get free hustler resources and other updates directly in your inbox

Discover More Episodes

League of Hustlers Podcast Player:

https://leagueofhustlers.com/loh-podcast-player/

Hustler Resources

How To Get Massive Traffic To Your Site: https://bit.ly/LoH-TrafficSecrets

Join the One Funnel Away Challenge: https://bit.ly/LoH-OFA

Marketing 101 for Entrepreneurs: GameFaceFormula.com

Social Media Strategy Guide: https://gamefaceformula.com/project/super-social-media-strategy/

How to Ensure You Have An Effective Website: https://gamefaceformula.com/project/the-max-impact-website-checklist/

Before You Jump – 4 Steps to Success: https://gamefaceformula.com/byj

Official LoH Merch

Social Media & Contact

Let’s chat in the LoH Facebook Group:

https://www.facebook.com/groups/leagueofhustlers/

Send in a Voice Message that we can feature on the show:

https://anchor.fm/league-of-hustlers/message

Have questions or want to be a guest on the show:

contact@league of hustlers.com